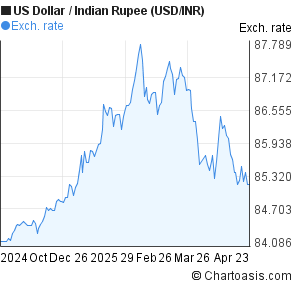

But once the Fed pivots towards rate cuts to support its economy, we could see the rupee appreciate strongly, taking USDINR towards 80 levels. USDINR pair can scale 82.50/83.00 region. That can lead to risk-off in the financial markets, which could drive the dollar slightly higher. "Over the next few months, there is a risk of the US economy slowing down and the stress in the banking sector increasing. The dollar tends to do well when either a relatively strong US economy compels the Fed to hike rates at a faster pace than its peers or when there is a flight to safety due to global financial market turmoil. The path forward for the dollar could be a mix of both, up and then down," said Banerjee. "The US dollar index has depreciated by nearly 12 per cent since the peak in October.

However, when compared in terms of volatility, the rupee has been a major outperformer, thanks to capital inflows and aggressive intervention from the RBI on both sides of the market.

Read more: Asian Development Bank may consider rupee-denominated bondsīanerjee underscored that in the current year till date, the Indian rupee has been a marginal outperformer when compared with its peers of 25 major currencies. On the other hand, Anindya Banerjee, VP of currency Derivatives & Interest Rate Derivatives at Kotak Securities is of the view that over the medium term, the path of the rupee will be dictated by the trend of the dollar against global currencies. We expect the dollar index to eventually move towards psychological levels of 100," said Singh. As long as it sustains below this level, the downtrend may remain intact. The dollar index is facing strong resistance near 103. "Dollar index after making a high of 105.88 in March 2023 again started losing its steam and slipped back near 101 levels. Singh pointed out that the dollar is losing its steam and is likely to slip further to 100 levels on anticipation that this would be the last rate hike and Fed to hit a pause button for a while, particularly due to lingering concerns over economic growth and a renewed banking crisis. Indian economy, too, is exhibiting resilience to external headwinds and is forecast to be in better shape compared to emerging countries," Singh observed. Additionally, India's CAD has narrowed to 2.2 per cent of GDP in the quarter ending December from 4.4 per cent of GDP in Q2FY23 and is likely to narrow further amid growth in service exports. Furthermore, softening crude oil prices may be supportive of the domestic currency as it will reduce import bills. "The rupee may appreciate in the medium term amid expectation of further weakness in the dollar. Singh said the rupee is likely to face a hurdle near 83 on the higher side, which has been a strong resistance for the past six months. He believes the rupee may move even below 80 against the dollar in the coming months. Raj Deepak Singh, Analyst – Currency, Commodity, and Derivatives at ICICI direct expects the rupee to appreciate towards 80.50 levels in the medium term. Read more: International trade in rupee currency soon, says Piyush Goyal However, there may be some intermittent volatility in the US dollar and Indian rupee (USDINR) pair according to the economic indicators. Most analysts are positive about the medium-term prospects of the dollar.

Usd to rupee full#

View Full Image Change (%) in some currencies against the dollar in 2023 so far.

0 kommentar(er)

0 kommentar(er)